mortgage services, guiding you to a secure future and

protecting what matters most, every step of the way.

bespoke life, health, asset, and business insurance

solutions to expertly safeguard what matters most.

solutions, securing your dream home or investment

with tailored guidance and expert service.

BSI Mortgage Advisers can help you with

Residential Loans

Commercial Loans

Other Loans

A Comprehensive Guide to Home Loans

A residential loan is a mortgage you take out to purchase a home. It involves repaying the loan principal plus interest over a specified period, typically 30 years.

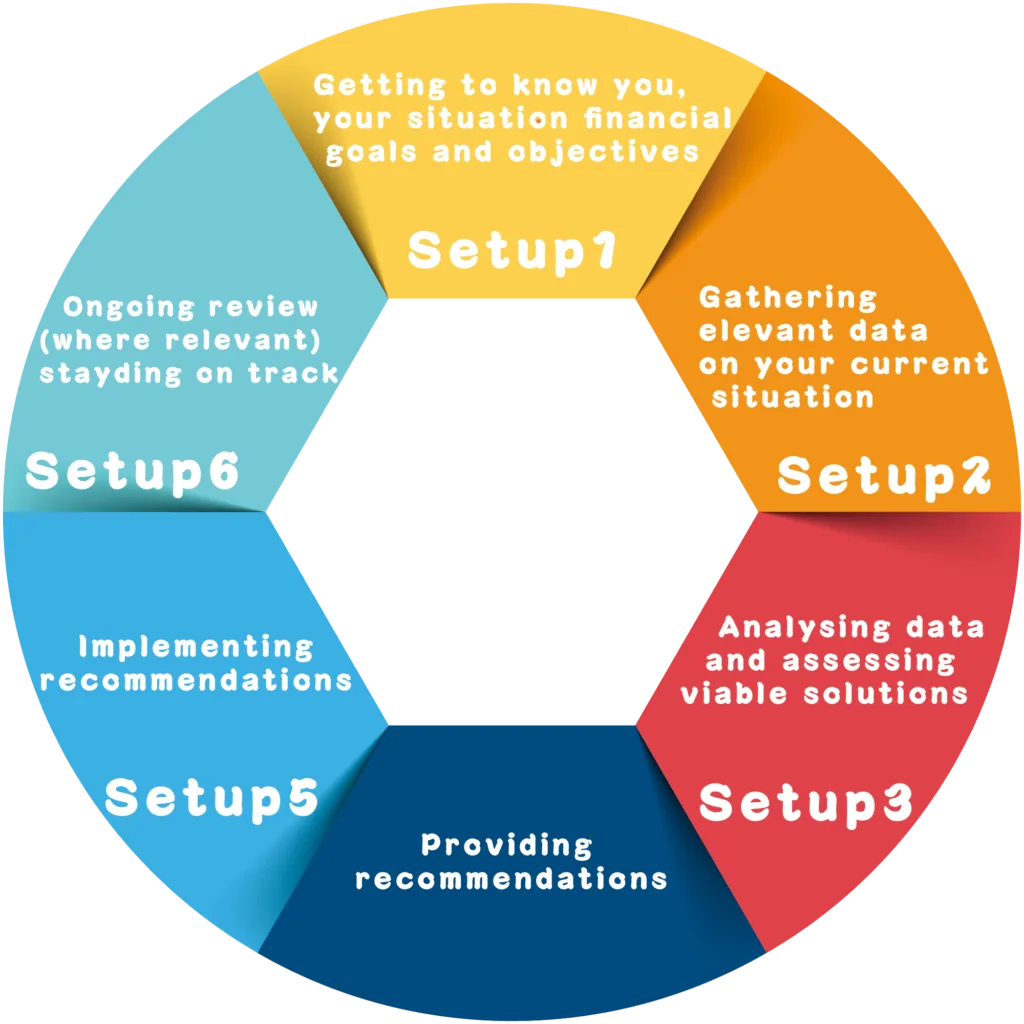

How We Operate?

Our Partners

What People Say

“The loan process with bsi brokers was incredibly easy and straightforward. The team helped me every step of the way, providing clear guidance and answering all of my questions. The approval was quick, and I received the funds much faster than expected. I highly recommend their loan services for anyone who needs financial assistance!”

Emmy Barton

“I was impressed with how bsi brokers handled my loan application. Their team was responsive, knowledgeable, and really took the time to ensure I understood all my options. The loan was approved in no time, and the terms were exactly what I needed. If you're looking for a hassle-free loan experience, they’re the ones to go to.”

Tina Johanson

“BSI Brokers made applying for a loan so simple. I had been struggling with other options, but their team helped me secure a loan that fit my financial needs. The process was fast, and I appreciated how transparent they were throughout. I would absolutely use them again in the future for any financial needs..”

Olivia Brooks

"The loan process with bsi brokers was very smooth and stress-free. The staff guided me through every step and explained everything clearly. I was able to get the loan I needed without any hidden fees or surprises. The entire experience was positive, and I highly recommend them to anyone in need of a reliable loan service."

Alex Turner

"BSI Brokers helped me secure a loan with the best interest rate I could find. They took the time to understand my needs and tailored a solution that worked for me. The application process was smooth, and I had access to my funds quickly. I'm so grateful for their help and will definitely consider them for any future financial needs."

James Foster

"The loan service provided by bsi brokers was exceptional. They were professional, quick to respond, and helped me get approved for a loan with great terms. I felt confident throughout the process, and their team was always available to answer my questions. I would highly recommend them to anyone looking for a reliable and efficient loan provider."

Emma Clarke

Mortgage FAQ`s

Find answers to the most common questions about mortgage, helping you make informed decisions and understand your coverage options.

How Does a Mortgage Work?

When you take out a mortgage, you agree to repay the loan amount plus interest over a specified period, usually 30 years for a home loan. Each monthly payment includes a portion of the principal (the original loan amount) and the interest. In the early years of the mortgage, a larger portion of the payment goes toward interest, while in the later years, more of the payment goes toward reducing the principal.

What Are the Types of Mortgages?

Mortgages come in various forms, each with its own features and benefits. Some common types include:

Fixed-Rate Mortgages

A fixed-rate mortgage has an interest rate that remains the same for the agreed term of the loan. This provides stability and predictability, as your monthly payments will not change over time.

Variable-Rate Mortgages

An Variable-rate mortgage has an interest rate that can fluctuate based on market conditions. Typically, it offers a higher interest rate compared to fixed-rate mortgages, but the rate can change periodically.

Interest-Only Mortgages

With an interest-only mortgage, you only pay the interest on the loan for a set period, usually 2 to 5 years. After this period, you begin paying both principal and interest.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a process in which a lender evaluates your financial situation to determine how much they are willing to lend you for a home purchase. Pre-approval involves a thorough review of your income, credit history, assets, and debts. Obtaining pre-approval can give you a better idea of your budget and make you a more attractive buyer to sellers.

How Can I Pay Off My Mortgage Faster?

There are several strategies to pay off your mortgage faster, including:

· Making Extra Payments: Paying more than the minimum monthly payment can reduce your principal balance faster and save on interest.

· Making Lump sum payments: If you come into a large sum of money, such as a work bonus, an inheritance, or a tax refund, you can use it to make a lump - sum payment on your mortgage principal.It reduce the amount of interest you'll pay over the life of the loan and shorten the loan term.

· Refinancing: Refinancing to a shorter loan term or a lower interest rate can help you pay off your mortgage quicker.

· Consider an offset account: The offset accounts are linked to your mortgage. The balance in the offset account is used to reduce the amount of interest you pay on your mortgage. For example, if you have a mortgage balance of $300,000 and $50,000 in an offset account, you'll only be charged interest on $250,000. By keeping more money in the offset account, you can effectively reduce the interest and pay off the mortgage faster.

What Are Additional Costs?

There are additional costs or expenses associated with finalizing a mortgage and purchasing a property. These can include house insurance, solicitor fees, and a valuation report or building report might also be required by bank.

How Do I Choose the Right Mortgage?

Choosing the right mortgage depends on your financial situation, goals, and preferences. Consider the following factors:

· Interest Rates: Compare rates from different lenders to find the best deal.

· Loan Terms: Determine if a short-term or long-term loan works better for your budget.

· Monthly Payments: Ensure you can comfortably afford the monthly payments.

· Down Payment: Decide on the amount you can put down upfront.

· Additional Costs: Consider solicitor fee, house insurance, and other fees.

Choosing a financial Adviser vs. Going Directly to a Bank?

Going directly to a bank often means dealing with a limited range of products and receiving advice that may be biased toward the bank's offerings. Financial adviser have access to a wide network of lenders, including banks, second-tier Lenders, and finance companies, which allows them to compare various mortgage products on your behalf.

Financial Adviser can provide ongoing support and adjust your financial plan as your life situation changes. For instance, if you experience a job loss or a significant increase in income, they can help you modify your mortgage repayment strategy or investment portfolio accordingly.