Comprehensive Commercial Insurance

Customized coverage for every business stage, protecting your assets, operations, and future growth.

Liability

Material Damage

Business Interruption

Professional Indemnity

Contract Works

Cyber Attack

Business liability protection

Protects businesses from claims and legal expenses arising from third-party bodily injury, property damage, or personal injury resulting from business operations or products.

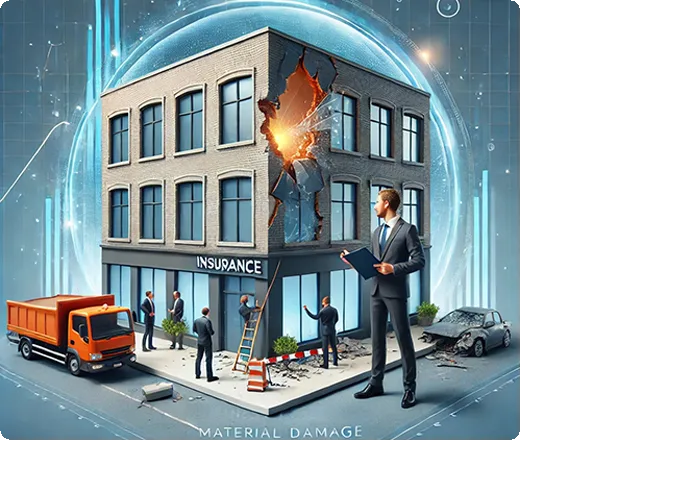

Business property protection

Provides coverage for damage or loss to a business’s property, including buildings, equipment, inventory, and supplies, due to events like fire, theft, vandalism, or natural disasters.

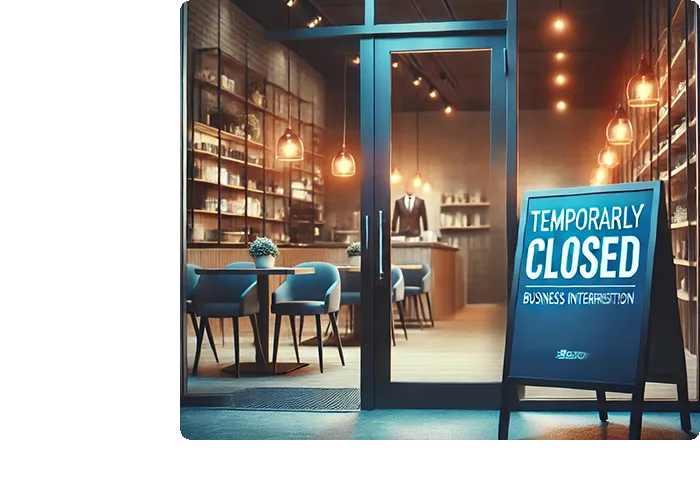

Business interruption coverage

Covers financial losses and expenses if a business is unable to operate due to a covered event, such as a fire or natural disaster, by compensating for lost revenue and ongoing expenses.

Professional liability insurance

Also known as errors and omissions (E&O) insurance, it offers protection against claims of negligence, errors, or omissions in professional services provided by businesses, such as consultants, lawyers, or architects.

Construction project insurance

Also known as construction all risks insurance or builders’ risk insurance, is a type of insurance coverage that provides protection for construction projects against a range of risks and losses that may occur during the course of the project.

It is typically taken out by contractors, builders, or property owners to cover the construction work and materials involved.

Cyber liability insurance

Protects businesses from losses and liabilities arising from data breaches, cyberattacks, or other cyber-related incidents that compromise sensitive customer information.

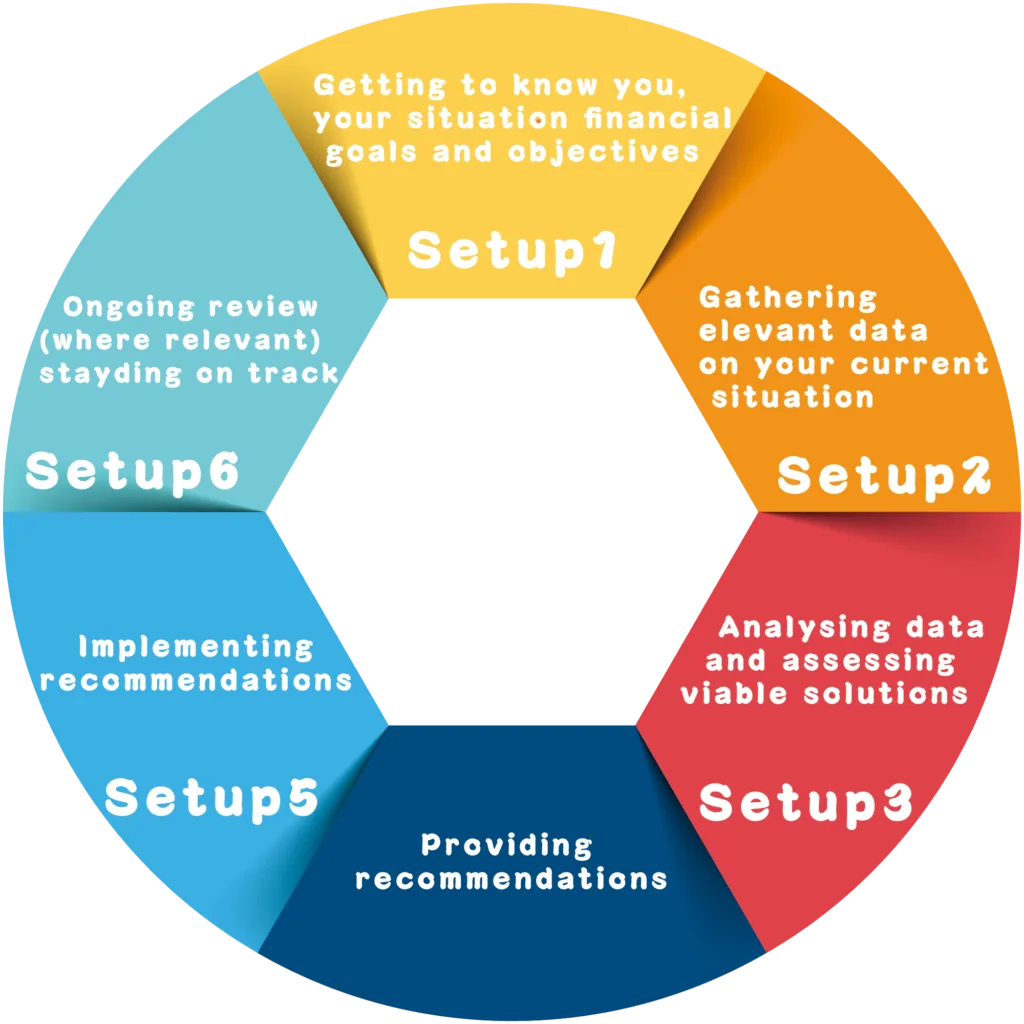

How We Operate?

Trusted Partners in Commercial Insurance

Commercial Insurance FAQ`s

Discover answers to common questions about commercial insurance, helping you make informed decisions and protect your business effectively.

Is there any difference between different insurance companies?

Basically, companies that can become commercial insurance companies are companies with relatively strong financial resources, and insurance companies will also have reinsurance. In fact, the products and services provided by each company are similar, but different companies have different price advantages, so this is why we provide a comparison of quotes from multiple insurance companies.

What types of insurance do you need to purchase in the general catering industry?

Public Liability (public liability insurance) is highly recommended and necessary, basically every company in various industries has a type of insurance. Covers all liability to third parties caused by own business actions (e.g. damage to buildings, food poisoning, injuries to customers in the store). If the merchant is judged by law to be responsible for its actions, public liability insurance will help the merchant compensate for losses caused to third parties.

If the restaurant catches fire, which insurance can I cover?

Fire should be regarded as the biggest risk in the catering industry. Once a fire occurs, for example, if the building is burned, the amount of compensation to the landlord is through the public liability insurance, because it is your own business (responsibility) that caused the store to burn. Due to the fire, the restaurant cannot continue to operate during this period. If you purchase business interruption insurance, you can also get compensation from the insurance company. Once the equipment and inventory in the store are also burned, the property damage insurance can also pay for this part of the loss.

What is the difference between content and stock? What is the actual example?

Content: Generally speaking, equipment belongs to the layout or purchase of some assets in the store, such as decoration, dining table, chairs, cash register, refrigerator, microwave oven, etc. Stock: Generally, it is the goods that the restaurant itself needs to use, such as inventory, ingredients, drinks, etc.